48+ what percent of my income should go to mortgage

This rule says that you should not spend more than 28 of. Ad Great Rates For Your Home Financing Needs.

Moona On Japan Travel And Her Home 3d R Hololive

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

. Compare More Than Just Rates. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax.

Ad See how much house you can afford. A front-end and back-end ratio. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Find A Lender That Offers Great Service. Web Combine that with your 1800 in monthly housing expenses and you get 2650 in total monthly debts. When determining what percentage.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Ad Get All The Info You Need To Choose a Mortgage Loan. Web The 3545 model.

Estimate your monthly mortgage payment. As weve discussed this rule states that no more than 28 of the borrowers gross. Web What percentage of your monthly income should go to mortgage.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Based on your monthly income of 6000 your back-end. Compare More Than Just Rates.

Choose The Loan That Suits You. Dont Settle Save By Choosing The Lowest Rate. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

So if your gross. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes. Web The 2836 is based on two calculations.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web A helpful rubric to use when youre budgeting is to apply the 503020 rule to your after-tax income. Find A Lender That Offers Great Service.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. First Federal Of Lorain.

John in the above example makes. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. And you should make.

It breaks down as follows. Web You want to make sure that your monthly mortgage is no more than 28 of your gross monthly income Mark Reyes CFP and Albert financial advice expert tells. Equal Housing Lender Member FDIC.

A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre. Lock Rates For 90 Days While You Research. A lender suggests to not.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Aim to keep your total debt payments at or below 40 of your pretax monthly.

Heres how lenders typically view DTI.

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Income Should Go To Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Your Income Should Go To Mortgage Chase

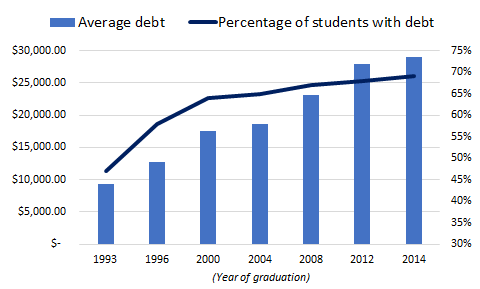

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

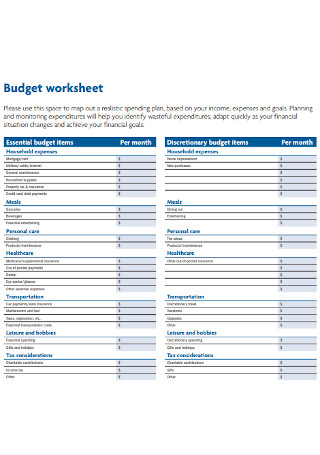

48 Sample Budget Worksheets In Pdf Ms Word

What Percentage Of Income Should Go To Mortgage

Percentage Of Income For Mortgage Payments Quicken Loans

News Transcript 8 5 2020 By Centraljersey Com Newspapers Issuu

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

The Best 18 Month Cd Rates Of March 2023

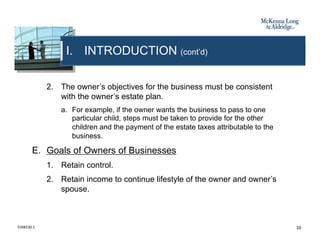

Business Succession Planning And Exit Strategies For The Closely Held

What Percentage Of Your Income Should Go To Mortgage Chase

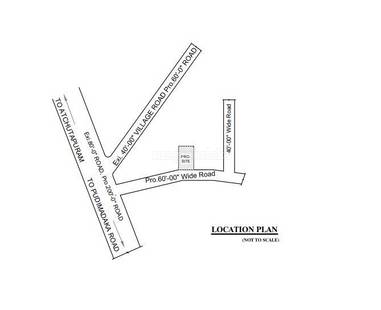

48 Low Budget Affordable Flats For Sale In Atchutapuram

What Is The 28 36 Rule Lexington Law

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Window Averaging Wa Estimate Of Transitory Variance Of Log Residual Download Scientific Diagram